proposed estate tax changes september 2021

Tax Changes for Individuals and Corporations. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

Ultimate Home Money Makeover Checklist In 2021 Money Makeover Financial Checklist Checklist

November 03 2021 In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives.

. House Ways and Means Committee Proposal Brings Big Changes for Estate Planning By Keith Grissom on September 15 2021 at 1015 AM On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the Build Back Better Act the Act. However the plan does not include. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for inflation beginning January 1 2022.

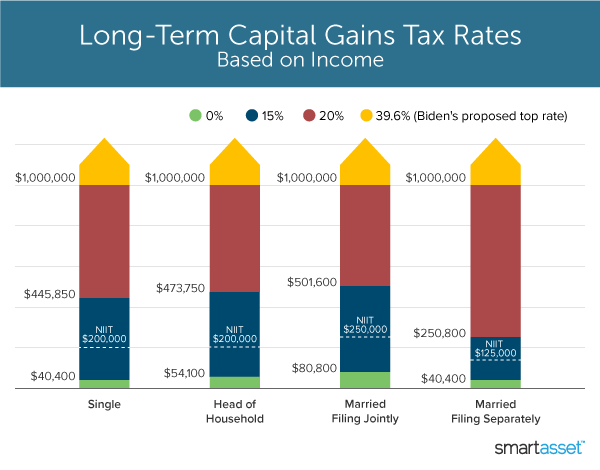

The effective date for this increase would be September 13 2021 but an exception would exist for gain recognized resulting from sales under binding contracts entered into prior to the effective date. Theyre likely to be revised in 2022. The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

The proposal includes an increase in the highest capital gains tax rate from 20 to 25. For tax year 2021 trust or estate income over 13050 is taxed at 37. Estate owners dodged some bullets in 2021.

Tax rate B applies to siblings half-siblings sons-in-law and daughters-in-law. Lifetime estate and gift tax exemptions reduced and decoupled. The new bill would increase the long-term capital gains tax rate from 20 to 25 on individuals with taxable income over 400000.

Houses 1 days ago The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. Estate Tax Watch 2021. Senate to impose higher taxes on certain estates.

The generation-skipping transfer tax GST tax exemption amount will also decrease from 117. Proposed effective date is retroactive to January 2021. The effective date for this increase would be September 13 2021 but an exception would exist for gain recognized.

Ultra Millionaire Tax Act of 2021 would tax household net wealth above 50 million at a 2 percent rate per year and above 1 billion at a 3 percent rate. Note the tension in current year planning if this proposal is adopted. Proposed Tax Law Changes Impacting Estate and Gift Taxes September 23 2021 September 26 2021.

The House Ways and Means Committee advanced its portion of the Proposed Act on September 15 2021 which addresses numerous fiscal issues including many tax increases. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year. The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35 million for transfers at death and 1 million for lifetime gifts.

The proposed bill seeks to increase the 20 tax rate on capital gains to 25. Any value beyond that number is taxed at a rate of 40 percent. On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the Build America Back Better Act On March 25 2021 Senator Bernie Sanders introduced a bill into the US.

Estate and gift tax exemption. September 27th 2021 On September 13 2021 the Chairman of the House Ways and Means Committee released the proposed Build Back Better Act the Proposed Act. The estate tax changes that were anticipated in the final months of 2021 are apparently not materializing leaving some.

September 23 2021 Proposed Tax Law Changes Impacting Estate and Gift Taxes David Bussolotta Pullman Comley LLC Follow Contact As many people are aware Congress is considering changes to the. Significant estate and gift tax increases were proposed early in the year but theyve been put on the back burner. Specifically the following proposals from prior versions of the bill are no longer included.

This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000 per person for transfers occurring after December 31 2021. The changes would be effective beginning after December 31 2021. Proposed Changes The proposal would impose a 3 surcharge tax on the gross income in excess of 100000 for a trust or estate 2500000 for a married individual filing a separate return and 5000000 for any other taxpayer.

Increase in Capital Gains Taxes effective as of September 13 2021. The increase is set to be effective for the tax. Individuals and married couples who expect to have assets at death in excess of the reduced federal estate tax exemption that would be available to them if the proposed tax changes were adopted 35 million per individual and who have not already fully used their federal giftestate and gst exemptions may wish to act now to take advantage of.

Proposes a 1 percent tax on wealth above 32 million for married couples 16 million for singles that increases to 8 percent for wealthier households. Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28. Proposed Estate and Tax Planning Changes in 2021 and.

What is unmentioned is what this bill lacks most of the proposed estate tax provisions. Under the proposed bill the estate tax exemption amount which is currently at 117 million per individual would revert to 5 million indexed for inflation effective January 1 2022. House Ways and Means Committee Proposal Lowers Estate Tax Exemption Friday September 17 2021 On Sunday September 12 th the House Ways and Means Committee released a draft.

Personal Income Tax Guide The Deadline For Filing Your 2021 Return Tax Brackets And More Moneysense

Pin By Anekia Meeks On Investment Investing Writing Income Tax

Ottawa Property Tax 2021 Calculator Rates Wowa Ca

It May Be Time To Start Worrying About The Estate Tax The New York Times

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Taxtips Ca Canadian Dividends No Tax

What Happened To The Expected Year End Estate Tax Changes

Brampton Property Tax 2021 Calculator Rates Wowa Ca

Sales Tax Definition What Is A Sales Tax Tax Edu

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

What S In Biden S Capital Gains Tax Plan Smartasset